Business Insurance in and around San Jose

One of the top small business insurance companies in San Jose, and beyond.

Cover all the bases for your small business

Your Search For Excellent Small Business Insurance Ends Now.

When you're a business owner, there's so much to take into account. You're not alone. State Farm agent Jim Edington is a business owner, too. Let Jim Edington help you make sure that your business is properly covered. You won't regret it!

One of the top small business insurance companies in San Jose, and beyond.

Cover all the bases for your small business

Surprisingly Great Insurance

If you're looking for a business policy that can help cover accounts receivable, business liability, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

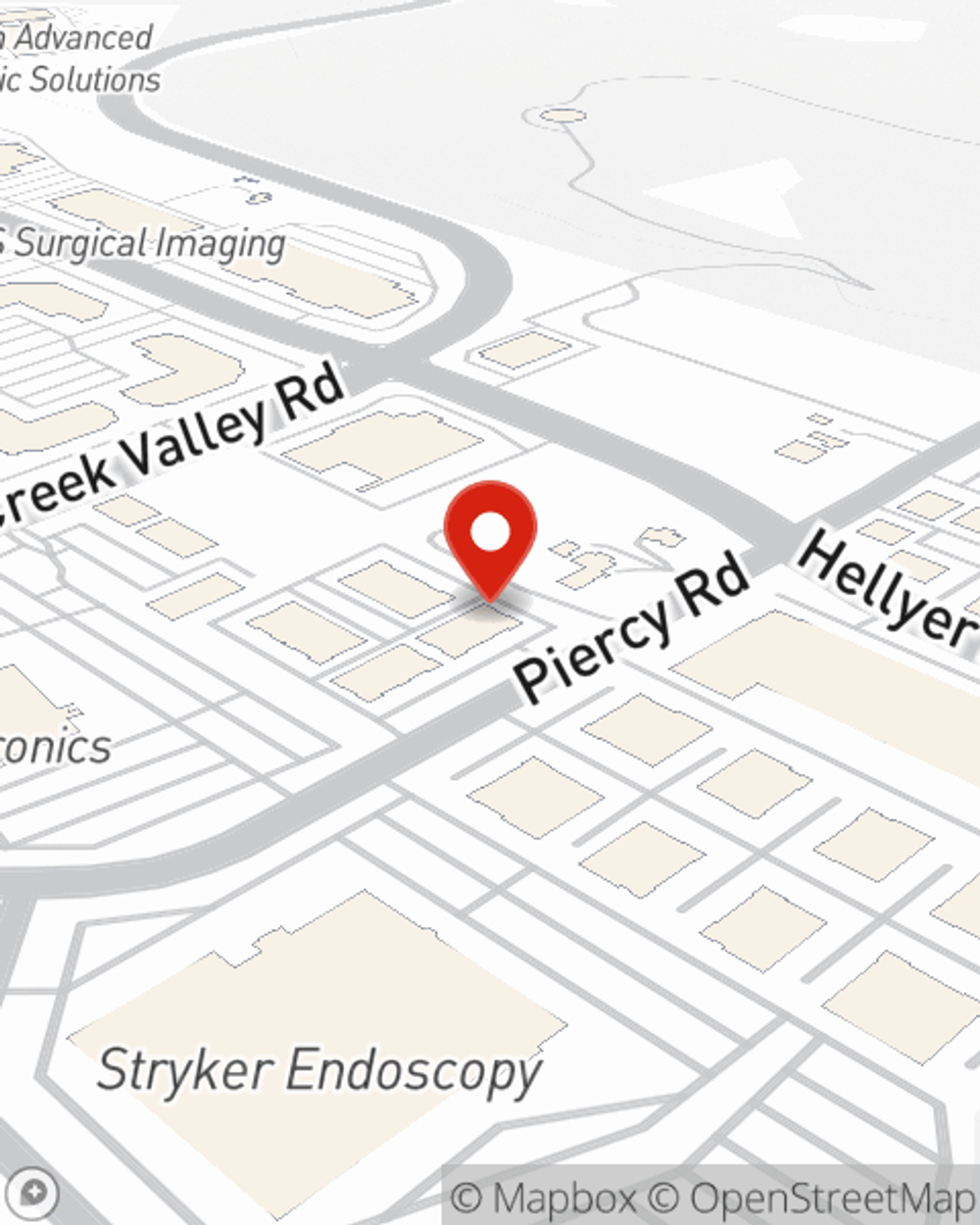

Visit the exceptional team at agent Jim Edington's office to learn more about the options that may be right for you and your small business.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Jim Edington

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.